Eversheds Sutherland | Tim Fosh | Sarah Burnside | Jen Green | Thomas E. Pritchard

United Kingdom

The FCA is consulting on a new regulatory proposition for targeted support in pensions and retail investments based on their consumer research

Why should I read this?

The FCA wants consumers to be confident making decisions about their pensions and to enable a greater culture of retail investment so that consumers can invest with confidence and targeted support has a role to play in this. In this briefing we focus on the retail investment aspects of targeted support. Our Pensions colleagues are considering the pensions aspects and will be publishing a separate client briefing in due course.

In consultation paper CP25/17 “Supporting consumers’ pensions and investment decisions: proposals for targeted support” the FCA are consulting on a new regulatory framework for ‘targeted support’ a new form of support that is different from that for other forms of advice, with its own set of rules and a dedicated authorisation gateway.

The consultation builds on the FCA’s “Advice Guidance Boundary Review: Retail Investments Consumer Research” and follows on from the FCA’s previous consultation paper, CP24/27 “Advice Guidance Boundary Review – proposed targeted support reforms for Pensions”.

See previous client briefings by our Pensions team:

- DC Insights: The advice gap – is targeted support the answer?

- FCA’s Advice/Guidance Boundary Review – implications for workplace pension schemes

What is targeted support?

Targeted support will allow firms to make specific recommendations designed for groups or cohorts of consumers, allowing those firms to direct consumers to products that would deliver better outcomes for them. For instance, a firm might alert customers holding sums in excess of £10,000 in cash about the higher returns that their savings might generate if they were invested in an equity fund held through a stocks and shares ISA. A firm giving targeted support will be able to suggest one or more specific investment products, including those which they offer themselves.

To the consumer, targeted support will manifest as their existing financial services providers sending them targeted adverts for specific products. In many cases, these products will be higher risk, potentially higher return products than the consumer currently holds, although targeted support could also be deployed to persuade clients to adopt lower risk products, with lower but more predictable returns.

Some consumers may find targeted support intrusive and unwelcome. Just as financial services firms are obliged under GDPR to allow consumers to opt out of certain kinds of communications, firms offering targeted support may want to consider offering a similar opt out for targeted support communications.

How targeted support fits in to the existing regulatory framework

Targeted support isn’t fully personalised financial advice and it will not be tailored to the specific needs of each individual recipient. It is designed to be provided to groups of consumers with common characteristics and provide better support to those who currently have no support at all. It has the potential to act as a stepping stone to more comprehensive investment advice for consumers who want or need more personalised advice.

Under the current regulatory framework, targeted support would fall within the definition of a ‘personal recommendation’ under Article 53 of the Regulated Activities Order (RAO), so the UK government will consult on creating a new regulated activity of ‘targeted support’, which will be distinct from the existing regulated activity of advising on investments.

The FCA intend to construct the targeted support regulatory framework using existing requirements where possible, underpinned by the Consumer Duty.

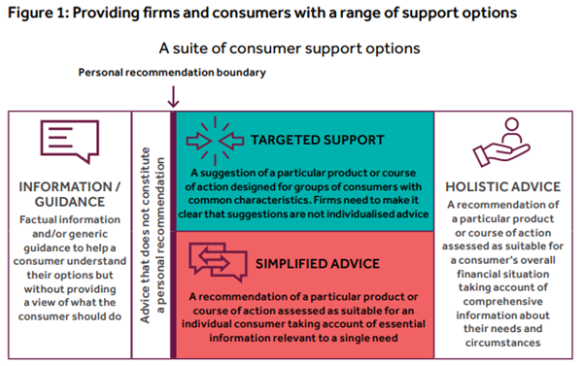

The following figure taken from CP25/17 illustrates how the FCA sees targeted support fitting into the existing advice and guidance matrix:

The consultation paper envisages firms delivering targeted support in situations in which they have reasonable grounds to consider that this would deliver better outcomes for customers than if targeted support was not provided.

Firms will need to pre-define:

- situations in which they intend to provide targeted support

- consumer segments to whom to provide targeted support

- ready-made solutions in these situation.

The ready-made solutions should be designed to help customers avoid foreseeable harm or meet their financial objectives.

Firms will then need to ensure each individual consumer to whom they wish to provide targeted support is both in the relevant pre-defined situation and falls within the relevant pre-defined consumer segment before giving the targeted support. Throughout the customer journey, firms will need to communicate with the consumer so that the consumer understands the nature of the recommendation they are receiving.

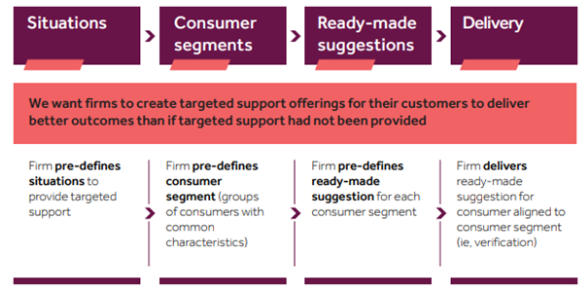

The following figure taken from CP25/17 illustrates how the FCA sees targeted support being designed and delivered:

Situations

The proposed rules define a ‘situation’ as “a common set of circumstances identified by a firm in relation to its clients involving a common financial support need or objective that the firm reasonably considers can be met with a suggestion.”

The FCA expects that when identifying situations firms should have regard to:

- the circumstances commonly encountered by their clients and whether these can reasonably be expected to be met through the provision of targeted support

- the overall purpose of targeted support

Firms should have reasonable grounds to consider that a proposed situation will deliver better outcomes for customers than if targeted support was not provided in relation to that situation. The draft rules imply that it would be prudent for firms to have supporting data to back up their rationale for their design of situations.

Segments

The proposed rules define a ‘consumer segment’ as “a group of individuals in a common situation involving a common financial support need or objective and, where relevant, sharing common characteristics”.

The characteristics of consumer segments:

- may be inclusive, such that they rule individuals into a particular consumer segment, e.g. consumers holding more than £10,000 in cash savings when considering a situation in which consumers might be able to achieve a better return without taking disproportionate risks;

- may be exclusive, such that they rule individuals out of the relevant consumer segment, e.g. excluding individuals with low life expectancy when considering a situation in which consumers may be advised to adopt a long term investment strategy;

- should not be overly complex;

- should not be so granular that they are overly individualised;

- should not be so broad that they are insufficiently granular; and

- should be such that a firm can define a suitable ready-made suggestion to deliver better outcomes for the consumer segment.

Reasonable assumptions can be made by firms when designing segments, such as that consumers within a segment have a particular investment horizon or risk appetite. The FCA is not necessarily suggesting that firms will need to disclose their assumptions, but they will need to consider whether non-disclosure is appropriate in light of the assumption.

Due skill, care and diligence

The FCA proposals require that firms must design and deliver targeted support with due skill, care and diligence.

Broadly, the FCA believe that such standards are likely to be satisfied if a firm:

- sensibly identifies situations posing a risk of foreseeable harm to customers or having the potential for customers to better meet their financial objectives;

- competently determines ready-made suggestions for those situations; and

- carefully identifies who that suggestion is for (or not for) so that the ready-made suggestion is not mis-delivered.

Firms should consider whether or not these points have been satisfied when designing and determining situations and consumer segments. The prudent approach will be for firms to record their rationale for settling on particular situations and consumer segments. Again, it is implied that firms will preferably have data to support their assessment.

Scope of targeted support

Firms will be able to give targeted support in respect of investments and pensions only (and so cannot be given in respect of products such as mortgages and pure protection insurance).

Targeted support will not involve any activity being becoming regulated if it is not currently regulated. The targeted advice framework will extend only to the provision of suggestions to give which firms would currently require Part 4A permission to advise on investments under Article 53 of the RAO.

How will it be funded?

The FCA says that is expects that in most cases targeted support will be delivered as a free service. The feedback that the FCA has received so far is that many firms intend to provide targeted support at no cost to the consumer, in the expectation that they would be able to defray the costs of providing such support from the commercial benefits of increased consumer engagement and retention.

The FCA reports that some firms are considering cross-subsidising targeted support, by covering the costs of providing the targeted support by increasing the charge of a related product or service. Any such cross-subsidisation will need to be reasonably representative of the cost of providing the targeted support. Some other firms plan to charge a fee for a bundle of services, including targeted support.

Any fees that are charged for targeted support must comply with the Consumer Duty, be justifiable on a fair value basis and clients provided with sufficient information to ensure the firm meets its Consumer Duty obligations. Fees must be disclosed and agreed with the firms’ clients as early as practicable before the targeted support is provided.

It is foreseeable that some, if not many, clients may not take kindly to being charged for the privilege of having firms promote products to them under the guise of providing them with targeted support, which firms will need to think carefully before charging for targeted support.

If a separate and specific charge is not levied, firms must ensure that their clients understand the basis upon which targeted support is provided. Firms will not be able to solicit or accept commission payments or other benefits in connection with their provision of targeted support.

Interaction with the Consumer Duty

The FCA is clear that firms do not need to offer targeted support in order to satisfy the Consumer Duty requirement to deliver good outcomes. However, as targeted support is a service for consumers, the Consumer Duty will apply to the design and delivery of all targeted support. The consultation paper sets out the components of the Consumer Duty that are relevant for firms to consider when designing and delivering targeted support.

Potential risks of investment product targeted support

Despite all of the safeguards in the targeted support proposals, ultimately one of the principal purposes of targeted support, as it has been promoted by the Chancellor of the Exchequer, is to persuade those who currently hold cash to invest part of their savings into higher-yielding equities and mutual funds. In particular, the Chancellor has stated a desire to increase the proportion of UK wealth that is invested in equities and mutual funds from the current rate of 8%, which is the lowest in the G7.

If targeted support works as intended, then many individuals who are ‘underinvested’ will move some of their cash savings into investments in equities and mutual funds. The underinvested currently disproportionately comprise women, the younger, the less affluent, certain ethnic minorities and vulnerable consumers in general. Without sufficient financial education, there is a risk that these newly minted investors, when they encounter their first market shock, such as the US tariff shock earlier this year, may be at greater risk of reacting to significant paper losses by selling their investments and crystallising those losses, rather than viewing the investment over a longer investment horizon. This risk will need to be carefully considered by firms, but at the same time it provides opportunities to provide greater financial education, which is arguably what has brought about the current position of underinvestment in the first place.

Next steps

The consultation closes on 29 August 2025 and responses should be submitted using the online form or emailed to mailto:cp25-17@fca.org.uk.

The FCA aim to publish a policy statement with final rules by the end of 2025, with an authorisations gateway for those seeking to undertake the regulated activity of giving targeted support expected to open in March 2026.

The FCA also proposes to:

- open the authorisations gateway before the new rules come into effect; and

- extend its Pre-Application Support Service (PASS) to firms planning to apply for targeted support permissions. (It says that PASS is a voluntary support service for firms before they formally apply for regulatory permissions. It is distinct from applying for permission itself and it helps firms prepare high quality applications and often facilitates faster assessments and decisions).

Firms considering providing targeted support may want to consider early engagement with the FCA.

This article first appeared on Lexology | Source